All accidents for which a claim was paid by an insurer are reported to the FCSA. Your claims history statement indicates your percentage of liability: 0%, 50% or 100%.

Frequently asked questions

I had this accident while driving my employer’s vehicle. Why is the claim on my claims history statement?

The FCSA has all claims in which you were involved, whether with your own vehicle, your employer’s vehicle or a borrowed vehicle.

When an insurer pays a claim, they must report that accident to the FCSA. In order to do so, they must determine who was the driver or custodian of the vehicle at the time of the accident.

I had an accident with a vehicle I rented or borrowed from a friend. Why is the claim on my claims history statement?

The FCSA has all claims in which you were involved, whether with your own vehicle, your employer’s vehicle or a borrowed vehicle.

When an insurer pays a claim, they must report that accident to the FCSA. In order to do so, they must determine who was the driver or custodian of the vehicle at the time of the accident.

When an insurer pays a claim, they must report that accident to the FCSA. In order to do so, they must determine who was the driver or custodian of the vehicle at the time of the accident.

If no one was driving the vehicle (e.g., if it was parked), the accident is added to the claim statement of the person who had custody of the vehicle at the time of the accident.

Often, it appears twice to show the information from your insurer and that from the insurer of the other party. This happens if the information provided by each insurer is not identical.

You can request that we verify the information. We will contact the insurer on your behalf.

If our analysis confirms that there was an input error, the statement will be corrected.

Only your insurer can change this information. Discuss it with them.

Insurers are responsible for reporting the information concerning the claims they pay to the FCSA. If you believe there is an error in your claims history statement, we can verify the information by contacting the insurer who reported it.

If our analysis confirms that there was an input error, the claims history statement will be corrected.

An accident in your claims history statement may have been added by:

- your insurer, whether it has paid you for a claim or not

and/or - the other party’s insurer, if there is one

If the accident occurred with your employer’s vehicle or a borrowed vehicle, the insurer who paid the claim will add the accident to your statement as the vehicle’s driver or custodian.

Your claims history statement will always indicate which version it is (your insurer or that of the other party involved).

I believe that my identity may have been stolen because I didn’t have any of the accidents in my claims history statement. What should I do?

We recommend that you request a verification on our website. Next, you can ask us to verify the information on your statement. If our analysis confirms that there is an error, your statement will be corrected.

Only your insurer can give you information about the claims it has paid. Discuss it with them.

If it is a recent accident that you received payment for, we recommend that you make another consultation request. There is always a delay between the payment and the accident being reported to the FCSA.

If it is an older accident that you did not receive payment for, it’s normal that this accident is not on your claims history statement. You were right to inform your insurer of your accident. If the other party involved had made a claim with their own insurer, your insurer would have your version of events. Your version would have offset the other party’s version.

You must declare any accident even if you do not plan to file a claim. Why?

- If the other party makes a claim, their insurer will report the accident to the FCSA and will name you as an involved person.

- If you contact your insurer, it will be able to determine whether you were responsible for the accident and add the information to your statement.

Reporting an accident does not mean you have to claim it!

Lexicon

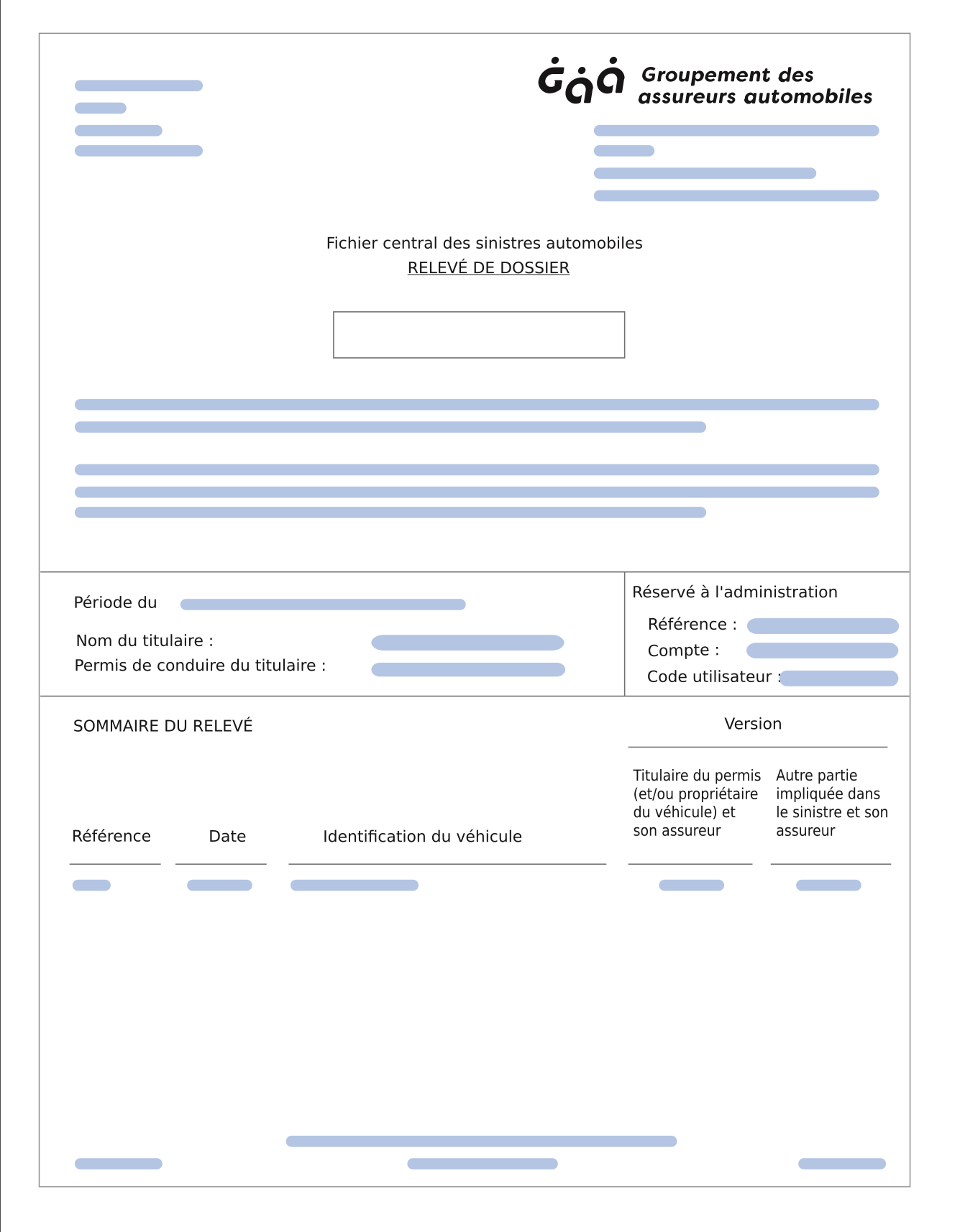

1 - General information

Name and address :

Your contact information.

Period :

The claims history statement lists the accidents involving you in the six years prior to the consultation date.

Driver’s licence of the licence holder :

Your driver’s license number.

2 - Claims history statement summary

Reference :

Number identifying each claim shown in the file.

Date :

Accident date.

Vehicle identification :

Make and model of the vehicle involved in the accident.

Version :

Indicates whether the accident was reported by your insurer or by that of the other party involved.

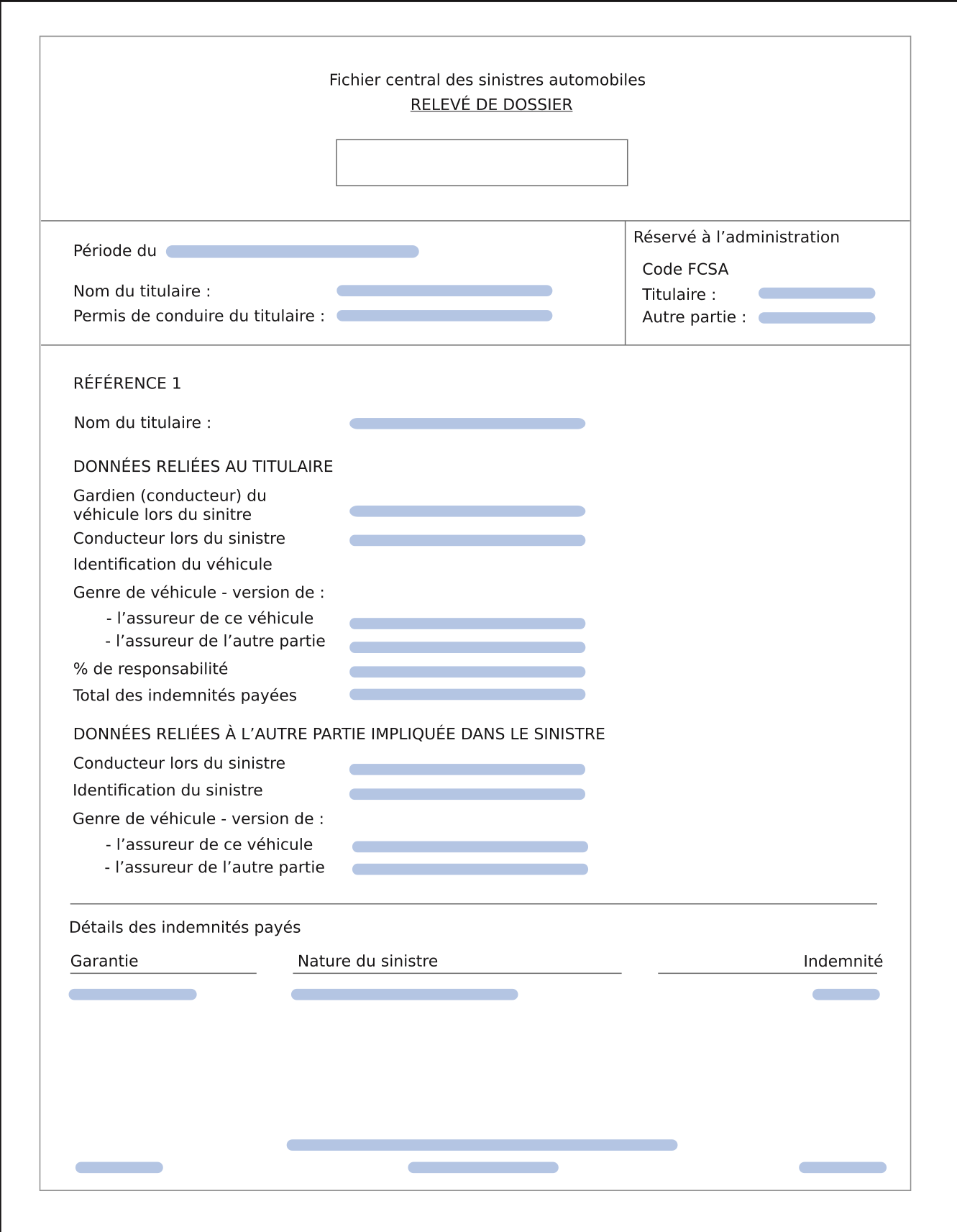

3 - Data related to the license holder

Custodian (drive) of vehicle at time of accident :

When an accident occurs without a driver (e.g., parked car), the accident is added to the file of the person who had custody of the vehicle at the time.

Driver at the time of accident :

The driver’s license number of the person driving the vehicle at the time of the accident.

Vehicle identification :

Make and model of the vehicle involved in the accident.

Vehicle type - version of :

Data used by insurers to determine contracts.

Liability % :

Your liability in the event of an accident, as assigned by your insurer.

Here is how liability is determined

Do you disagree with the liability percentage you have been assigned?

Only your insurer can change this information. Discuss it with them.

Total claim payment :

This is the total amount paid by your insurer for this claim.

4 - Data related to the other party involved in the accident

Driver at the time of accident :

First five characters of the driver’s licence number of the driver of the other vehicle involved in the accident. Only this information is shown for security reasons.

Vehicle identification :

Make, model and year of the other party’s vehicle, and code assigned to the vehicle.

Vehicle type — version of :

Data used by the insurer to determine its contracts.

5 - Claim payment breakdown

Coverage :

This section shows the insurance policy coverage under which the claim was paid. Different types of coverage can apply.

Kind of loss :

These codes are used by the insurer to identify under which coverage the claim was paid.

Payment :

The details of the payments made for each type of coverage.

If you have any questions about your claims history statement, make sure you have a copy so that our agents can help you.

Need your claims history statement?

Request it online for free